how much does illinois tax on paychecks

No Illinois cities charge a local income tax on top of the. Payroll benefits and everything else.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

The Illinois state income tax is a flat rate for all residents.

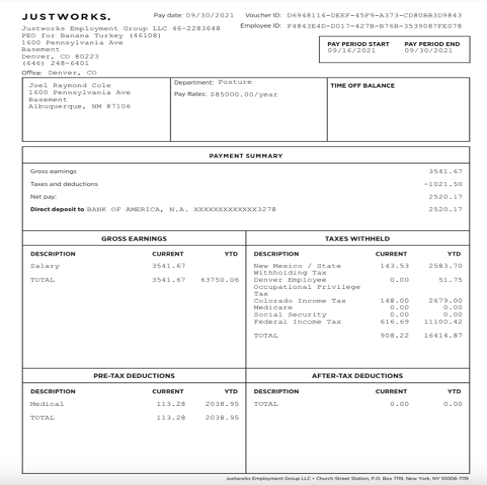

. Employers in Illinois must deduct 145 percent from each employees paycheck. Employers are responsible for deducting a flat income tax rate of 495 for all employees. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis.

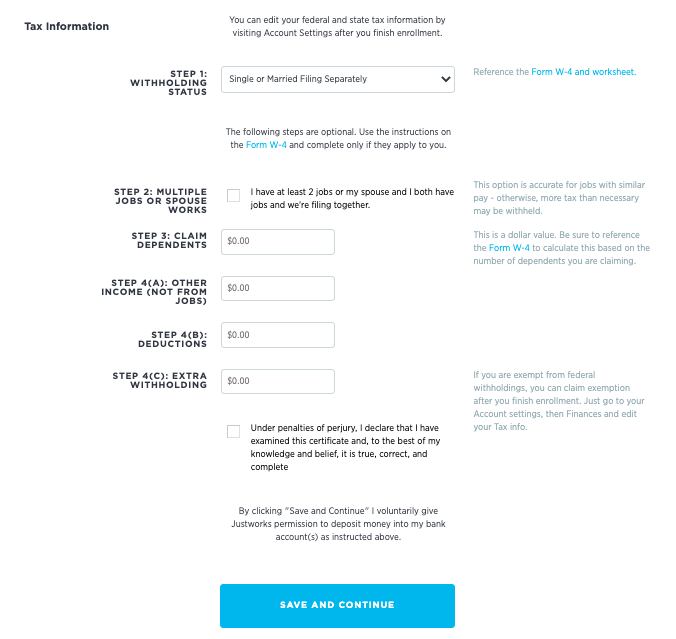

This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. Unlike Social Security all earnings are subject to Medicare taxes. Rates are based on several factors including your industry and the amount of previous benefits paid.

If an employees hourly rate is 12 and they worked 38 hours in the pay period the employees gross pay for that paycheck is 45600 12 x 38. The Illinois salary calculator will show you how much income tax is taken out of. 505 on the first 44470 of taxable income.

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. Occupational Disability and Occupational Death Benefits are non-taxable. Therefore fica can range between 153 and 162.

How much does wisconsin take. How Much Does Illinois Tax On Paychecks. Personal Income Tax in Illinois.

How To Calculate Taxes Taken Out. How much tax is deducted from a paycheck Canada. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Yes Illinois residents pay state income tax. This 153 federal tax is made up of two parts. As of January 1 2022 the Illinois unemployment tax rate ranges from 0725 to 7625.

You exceed 12000 in withholding during a quarter it is your responsibility to begin to pay your Illinois withholding income tax semi-weekly in the following quarter the remainder of the year. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Personal income tax in Illinois is a flat 495 for 2022.

According to the Illinois Department of Revenue all incomes are created equal. Illinois paycheck calculator Payroll Tax Salary Paycheck Calculator Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or. 915 on portion of taxable income over 44470 up-to 89482.

Employees who file for.

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Illinois Paycheck Calculator Smartasset

Illinois Paycheck Calculator 2022 2023

Different Types Of Payroll Deductions Gusto

Payroll Software Solution For Illinois Small Business

True Or False Trump S Payroll Tax Cut Means Your Paycheck Will Get Bigger Money

Here S How Much Money You Take Home From A 75 000 Salary

Illinois Paycheck Calculator Adp

2022 Federal State Payroll Tax Rates For Employers

Questions About My Paycheck Justworks Help Center

How To Run Payroll For Your Small Business On Your Own

Rep Kinzinger Votes To Overhaul America S Tax Code U S House Of Representatives

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes Methods Examples More

Questions About My Paycheck Justworks Help Center

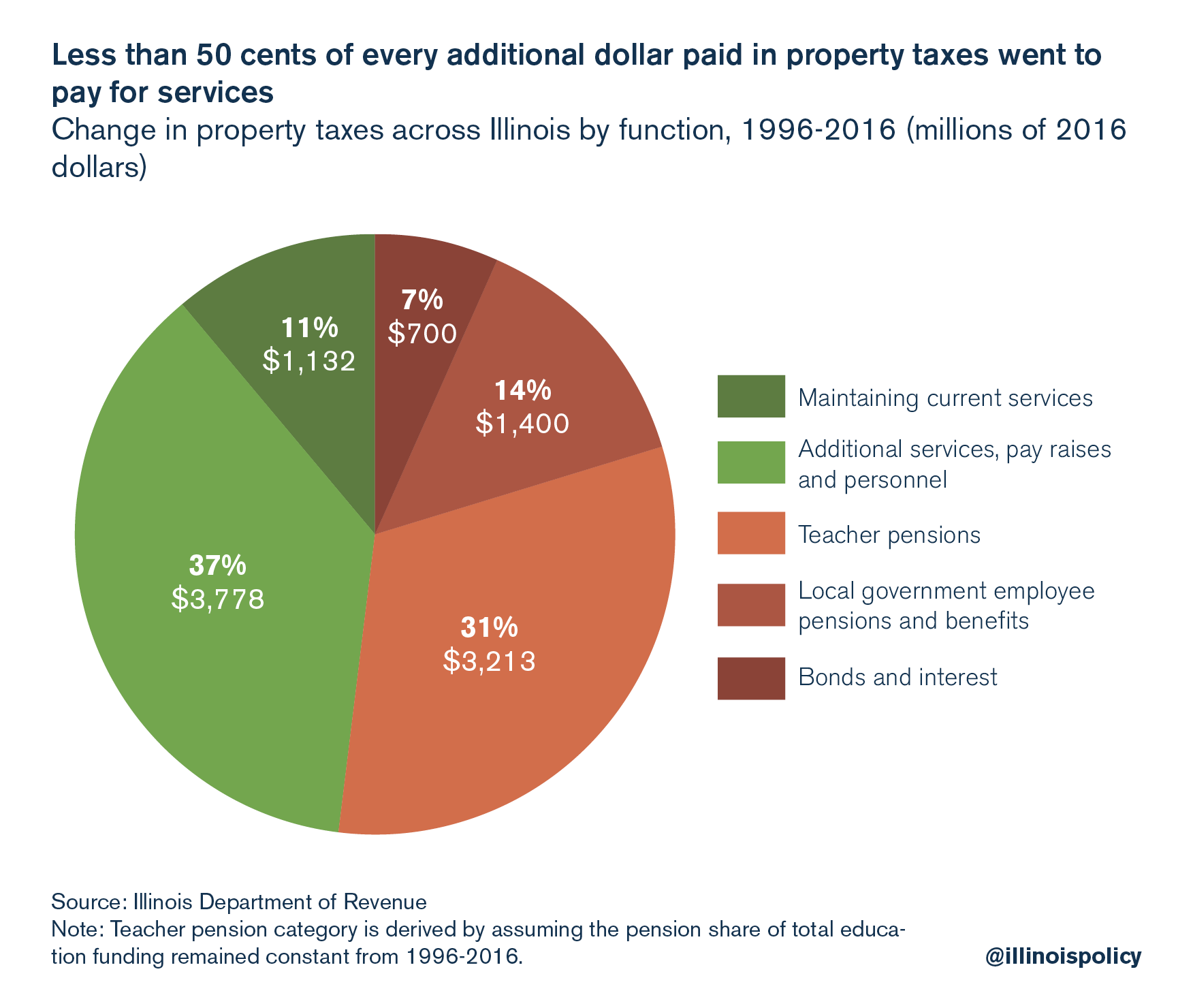

Study Illinois Property Taxes Still Second Highest In Nation